Multiple Choice

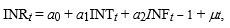

The following regression model was estimated to forecast the value of the Indian rupee (INR) :

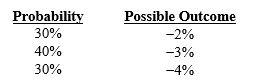

Where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the United States and India, and INF is the inflation rate differential between the United States and India in the previous period. Regression results indicate coefficients of a₀ = .003; a₁ = -.5; and a₂ = .8. Assume that INFt - 1 = 2 percent. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

The expected change in the Indian rupee in period t is:

A) 3.40 percent.

B) 0.40 percent.

C) 3.10 percent.

D) 1.70 percent.

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If the forward rate is used as

Q14: Exchange rates one year in advance are

Q21: Assume that interest rate parity holds. The

Q47: Which of the following is not one

Q53: Which of the following forecasting techniques would

Q63: Since the forward rate does not capture

Q65: If graphical points lie above the perfect

Q69: If a foreign country's interest rate is

Q72: Factors such as economic growth, inflation, and

Q74: Which of the following is true according