Multiple Choice

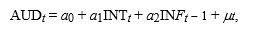

The following regression model was estimated to forecast the percentage change in the Australian dollar (AUD) :

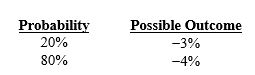

Where AUD is the quarterly change in the Australian dollar, INT is the real interest rate differential in period t between the United States and Australia, and INF is the inflation rate differential between the United States and Australia in the previous period. Regression results indicate coefficients of a₀=.001; a₁=-.8; and a₂=.5. Assume that INFt - 1 = 4%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

There is a 20 percent probability that the Australian dollar will change by ____, and an 80 percent probability it will change by ____.

A) 4.5 percent; 6.1 percent

B) 6.1 percent; 4.5 percent

C) 4.5 percent; 5.3 percent

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Fundamental models examine moving averages over time

Q7: A forecast of a currency one year

Q11: Leila Corp. used the following regression

Q14: If today's exchange rate reflects any historical

Q17: Monson Co., based in the United States,

Q28: If the pattern of currency values over

Q43: A fundamental forecast that uses multiple values

Q51: If speculators expect the spot rate of

Q52: A forecasting technique based on fundamental relationships

Q72: A regression model was applied to explain