Multiple Choice

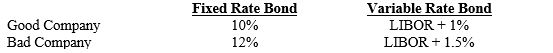

Good Company prefers variable to fixed rate debt. Bad Company prefers fixed to variable rate debt. Assume that Good and Bad Companies could issue bonds as follows:

A) an interest rate swap will probably not be advantageous to Good Company because it can issue both fixed and variable debt at more attractive rates than Bad Company.

B) an interest rate swap attractive to both parties could result if Good Company agreed to provide Bad Company with variable rate payments at LIBOR + 1 percent in exchange for fixed rate payments of 10.5 percent.

C) an interest rate swap attractive to both parties could result if Bad Company agreed to provide Good Company with variable rate payments at LIBOR + 1 percent in exchange for fixed rate payments of 10.5 percent.

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Fixed rate loans have interest rates that

Q2: If an MNC borrows funds in a

Q14: The yields offered on newly issued bonds

Q16: When a financial institution acts as a(n)

Q17: _ swaps are oFten used by companies

Q20: In a(n) _ swap, the notional value

Q21: Assume a U.S.-based subsidiary wants to raise

Q22: A limitation of interest rate swaps is

Q25: If U.S. firms issue bonds in _,

Q36: Foreign subsidiaries of U.S. MNCs can avoid