Multiple Choice

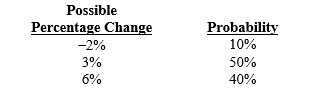

A firm forecasts the euro's value as follows for the next year:

The annual interest rate on the euro is 7 percent. The expected value of the effective financing rate from a U.S. firm's perspective is about:

A) 8.436 percent.

B) 10.959 percent.

C) 11.112 percent.

D) 11.541 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Euronotes are underwritten by:<br>A) European central banks.<br>B)

Q4: The interest rates on Euronotes are based

Q7: If interest rate parity exists and the

Q17: Assume the U.S. interest rate is 7.5

Q18: When a U.S. firm borrows a foreign

Q19: MNCs may be able to lock in

Q27: Firms that believe the forward rate is

Q28: Assume Jelly Corporation, a U.S.-based MNC, obtains

Q29: Assume that the Swiss franc has an

Q47: Which of the following statements is false?<br>A)