Multiple Choice

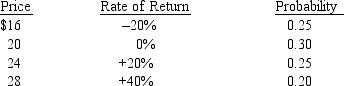

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the coefficient of variation for the rate of return on Phoenix stock.

A) 0.0

B) 2.68

C) 2.61

D) 0.275

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The _ is a statistical measure of

Q30: Recalling the meaning and calculation of beta,

Q33: The slope of the characteristic line for

Q36: An increase in uncertainty regarding the future

Q37: Don has $3,000 invested in AT&T with

Q38: A diversified portfolio has many stocks as

Q39: HDTV has planned on diversifying into the

Q66: The security market line can be thought

Q97: The expected rate of return for the

Q118: An investor who believes the economy is