Multiple Choice

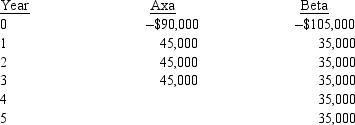

Toy Manufacturers (TM) is considering two mutually exclusive machines to use in its manufacturing process.The net cash flows for each are given below:

If the cost of capital for TM is 13%, which machine should they purchase?

A) Beta: has the highest total net cash flows

B) Beta: it has the highest NPV

C) Axa: it has the highest NPV using infinite replacement

D) Beta: it has the highest NPV using infinite replacement

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The best way to measure projects with

Q11: Boomerang Bungee Corp.is considering the following

Q12: When two or more mutually exclusive alternative

Q13: What is the equal annual annuity

Q14: What would be the equal annual

Q14: What does a firm ignore if it

Q15: Kaneb is evaluating two alternative pipeline welders.Welder

Q17: is (are) used when evaluating mutually exclusive

Q18: Using the equivalent annual annuity method, which

Q20: Casa Chica is considering replacing a piece