Multiple Choice

Parnell Industries

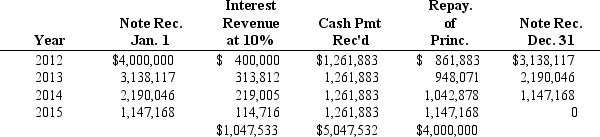

Parnell Industries sold a copy machine to Ranger Inc. on January 1, 2012. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Parnell to manufacture. Ranger will make four payments at the end of each year, beginning with 2012, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below:

-If Parnell Industries is certain that it will collect all four payments from Ranger Inc.what amount of gross profit should Parnell recognize in 2012 from the sale?

A) $0

B) $861,883

C) $172,377

D) $800,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Derivative instruments acquired to hedge exposure may

Q28: A company may try to paint a

Q32: The _ is equal to the actuarial

Q33: Gorilla,Corp.implemented a defined-benefit pension plan for its

Q36: A company that uses LIFO will find

Q37: Derivatives are financial instruments that derive their

Q38: Analysts concerns with postretirement benefits include all

Q52: Gains and losses on cash flow hedges

Q57: The difference between the economic resources received

Q62: A minimum liability for pension expense is