Essay

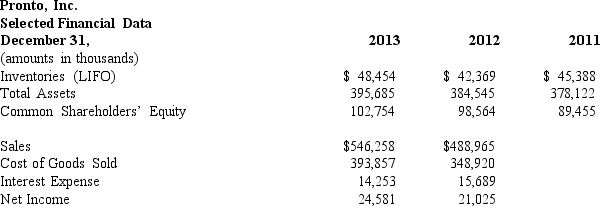

Pronto,Inc.is a major producer of printing equipment.Pronto uses a LIFO cost-flow assumption for inventories.The company's tax rate is 35%.Below is selected financial data for the company.

Required:a.The excess of FIFO over LIFO inventories was $25 million on December 31,2013,$28.5 million on December 31,2012 and $22 million on December 31,2011.Compute the cost of goods sold for Pronto,Inc.for years 2013 and 2012 assuming that it had used a FIFO assumption.

b.Compute the inventory turnover ratio for Pronto,Inc.for years 2013 and 2012 using a LIFO cost-flow assumption.

c.Compute the inventory turnover ratio for Pronto,Inc.for years 2013 and 2012 using a FIFO cost-flow assumption.

d.Compute the rate of return on assets for years 2013 and 2012 based on the reported amounts.Disaggregate ROA into profit margin and asset turnover components.

e.Compute the rate of return on assets for years 2013 and 2012 assuming that Pronto,Inc.had used the FIFO method of accounting for inventories.Disaggregate ROA into profit margin and asset turnover components.

Correct Answer:

Verified

Required:

a.The excess of FIFO over LIFO...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a.The excess of FIFO over LIFO...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Falcon Networks<br>Falcon Networks is a leading

Q11: When cash collectibility is uncertain the _

Q18: Firm A places its order for the

Q23: Dividing a company's income tax expense by

Q27: When input prices are increasing,companies that use

Q29: All of the following are most likely

Q39: Although LIFO generally provides higher quality earnings

Q48: Under U.S.GAAP,application of the LIFO and FIFO

Q66: To calculate a company's average tax rate

Q72: Deferred tax liabilities result in future tax