Essay

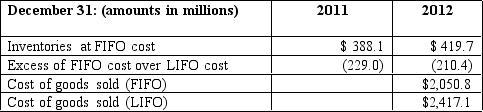

A large manufacturer recently changed its cost-flow assumption method for inventories at the beginning of 2012.The manufacturer has been in operation for almost 40 years,and for the last decade,it has reported moderate growth in revenues.The firm changed from the LIFO method to the FIFO method and reported the following information:

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Correct Answer:

Verified

LIFO and FIFO Cost-Flow Assumption for I...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: A derivative has one or more _,which

Q26: Which of the following is not a

Q41: Falcon Networks<br>Falcon Networks is a leading

Q50: When firms use derivatives effectively to manage

Q57: Under the completed contract method<br>A) revenue and

Q58: Many firms use derivative instruments to hedge

Q63: Given the following information,compute December 31,2012

Q63: Under the accrual method of accounting,when a

Q67: The following schedule was taken out

Q78: All of the following are events that