Essay

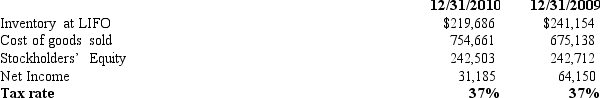

The following information is taken from Satin financial statements (amounts in thousands):

Inventory Footnote: If the first-in,first-out method of accounting for inventory had been used,inventory would have been approximately $26.9 million and $25.1 million higher than reported at 12/31/2010 and 12/31/2009,respectively.

Required: a.Calculate what inventory would have been at 12/31/2010 and 12/31/2009 had the FIFO inventory method been used.

b.What would net income for the year ended 12/31/2010,have been if the FIFO inventory method been used?

c.Calculate what stockholders' equity would have been at 12/31/2010 and 12/31/2009 had the FIFO inventory method been used.

Correct Answer:

Verified

a.Calculate what inventory would have be...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Derivative instruments acquired to hedge exposure may

Q33: A LIFO liquidation during periods when prices

Q36: A company that uses LIFO will find

Q38: Analysts concerns with postretirement benefits include all

Q41: When cash collectibility is uncertain,a firm using

Q44: At the end of 2012 Funtime

Q45: Which of the following accounts would not

Q57: The difference between the economic resources received

Q62: A minimum liability for pension expense is

Q74: Which of the following is not part