Essay

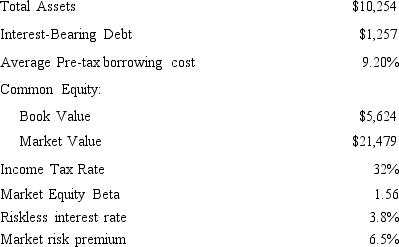

The following data pertain to Loren Corporation (dollar amounts in thousands):

Using this information,calculate the following: a.Loren Corporation's cost of equity capital

b.The weight on debt capital that should be used to calculate Loren's weighted-average cost of capital.

c.Loren Corporation's weighted-average cost of capital

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Explain the theory behind the dividends valuation

Q6: Firm-specific factors that increase the firm's nondiversifiable

Q9: The historical discount rate of the firm

Q17: Identify the types of firm-specific factors that

Q19: Under the assumption of clean surplus accounting,how

Q29: Zonk Corp.<br>The following data pertains to

Q30: Normally,valuation methods are designed to produce reliable

Q31: The dividends valuation approach measures value-relevant dividends

Q33: In what case will using dividends expected

Q38: If a firm has a market beta