Essay

Carr Industries must raise $100 million on January 1,2012 to finance its expansion into a new market.The company will use the money to finance construction of four retail outlets and a distribution center.The stores are expected to open later this year.The CFO has come up with three alternatives for raising the money:

1)Issue $100 million of 8% nonconvertible debt due in 20 years.

2)Issue $100 million of 6% nonconvertible preferred stock (100,00 shares).

3)Issue $100 million of common stock (1 million shares).

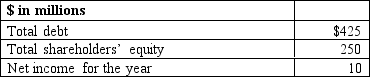

The company's internal forecasts indicate the following 2012 year-end amounts before any option is chosen:

Carr has no preferred stock outstanding but currently has 10 million shares of common stock outstanding.EPS has been declining for the past several years.Earnings in 2011 were $1 per share,which was down from $1.10 during 2010,and management wants to avoid another decline during 2012.One of the company's existing loan agreements requires a debt-to-equity ratio to be less than2.Carr pays taxes at a 40% rate.

Required:1.Assess the impact of each financing alternative on 2012 EPS and the year-end debt to equity ratio.

2.Which financing alternative would you recommend and why?

Correct Answer:

Verified

1.Calculations for earnings per share (E...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A company with a new<br>Capital structure will

Q21: A company with a market beta of

Q28: Bridgetron<br>An analyst wants to value the

Q39: Returns on systematic risk-free securities (like U.S.Treasury

Q41: Because the market equity beta reflects the

Q42: The CAPM computes expected rates of return

Q45: One criticism in using the CAPM to

Q45: Watson manufactures and sells appliances.Intro develops and

Q47: Zonk Corp.<br>The following data pertains to

Q51: Investors typically accept a lower risk-adjusted rate