Multiple Choice

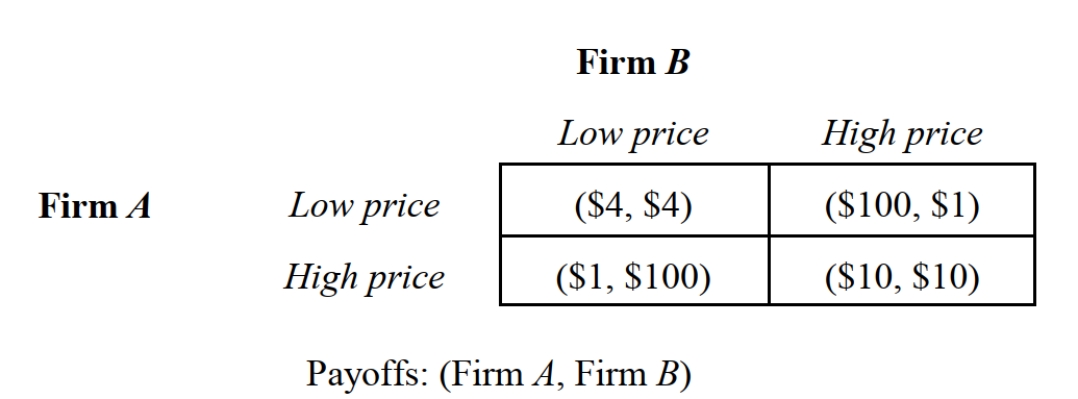

-Consider the pricing game depicted in Figure 5.5 in which payoffs are in millions of dollars. Suppose that this game is played repeatedly and the probability that the game will end in the next stage is 20 percent and the discount rate is 20 percent. What is the present value of the stream of future payoffs if either firm defects?

A) $8 million.

B) $12 million.

C) $18 million.

D) $30 million.

E) $108 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBR1330/.jpg" alt=" -Consider the oil-drilling

Q2: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBR1330/.jpg" alt=" -Consider the pricing

Q3: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBR1330/.jpg" alt=" -Consider the two-stage

Q5: The problem with a tit-for-tat strategy is

Q6: A scorched earth policy is a:<br>A) Strategic

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBR1330/.jpg" alt=" -Consider the noncooperative

Q8: The reason why a door-to-door salesman is

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBR1330/.jpg" alt=" -Consider the oil-drilling

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBR1330/.jpg" alt=" -Consider the oil-drilling

Q11: The probability that a two-player, repeated game