Short Answer

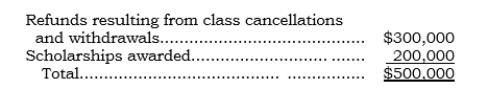

_____ During 2006, Sodona State University (SSU) billed its students $9,000,000 for tuition. The net amount contractually to be paid was only $8,500,000, however, because of the following items:

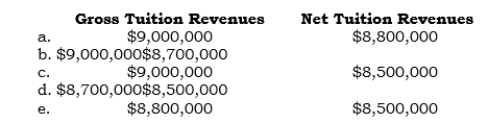

Which of the following amounts should SSU--which engages only in business-type activities-report in its 2006 statement of revenues, expenses, and changes in net assets?

Which of the following amounts should SSU--which engages only in business-type activities-report in its 2006 statement of revenues, expenses, and changes in net assets?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Under FAS 117, private nonprofit organizations must

Q2: _ Under FAS 117, how would the spending

Q3: _ Under FAS 117, how would the expiration

Q4: _ Under FAS 116, donor-restricted contributions are recognized

Q6: Under FAS 117, private nonprofit organizations must

Q7: Under FAS 117, expirations of restrictions must

Q8: For a permanent endowment created by a

Q9: The imputed value of charity care provided

Q10: _ For a public C&U engaged in business-type

Q11: Contributions of monetary and nonmonetary assets are