Multiple Choice

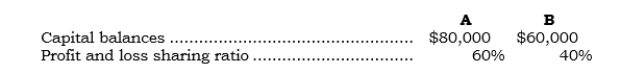

_____ Data for the partnership of A and B follow: Cook is to be admitted into the partnership and is to have a one-fifth interest in capital and profits with a cash contribution of $40,000. The balances in the capital accounts of A, B, and C under the bonus method are:

Cook is to be admitted into the partnership and is to have a one-fifth interest in capital and profits with a cash contribution of $40,000. The balances in the capital accounts of A, B, and C under the bonus method are:

A) $80,000, $60,000, and $40,000, respectively.

B) $92,000, $68,000, and $40,000, respectively.

C) $95,000, $65,000, and $40,000, respectively.

D) $82,400, $61,600, and $36,000, respectively.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: When a partnership's existence is terminated, the

Q5: When an existing partnership has goodwill and

Q6: _ When a person is being admitted

Q7: _ When a person is being admitted

Q8: When an existing partnership that has goodwill

Q10: _ Data for the partnership of X

Q11: _ Data for the partnership of X

Q12: Legally, a change in the ownership of

Q13: _ The purchase of an interest from

Q14: _ When a partner withdraws from a