Multiple Choice

_____ At 12/31/06, Pivlex had a $60,000 dividend receivable on its books from its foreign subsidiary. The dividend of 100,000 LCUs was declared on 12/28/06, when the direct exchange rate was $.60. The dividend was remitted to Pivlex on 1/8/07, when the direct exchange rate was $.62. The direct exchange rate at 12/31/06 was $.59. Pivlex uses the temporal method of translation. At 12/31/06, Pivlex should

A) Adjust the Dividend Receivable account downward and debit OCI-Translation Adjustment for $1,000.

B) Adjust the Dividend Receivable account downward and debit FX Transac-tion Loss for $1,000.

C) Make no adjustment to the Dividend Receivable account.

D) Adjust the Dividend Receivable account upward by $2,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

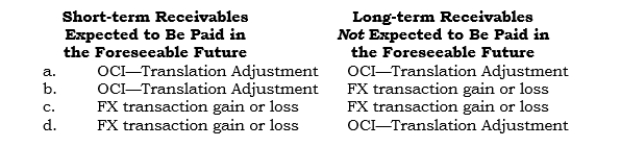

Q192: When the temporal method is used and

Q193: The functional currency concept is based on

Q194: Mixing of valuation bases (foreign fixed assets

Q195: _ Which of the following items is

Q196: Under FAS 52, an autonomous foreign unit

Q198: Popp owns 100% of the outstanding common

Q199: _ Under the temporal method of translation,

Q200: _ Following are certain items (accounts or

Q201: _ Pellax owns 100% of the outstanding

Q202: _ Pilax owns 100% of the outstanding