Short Answer

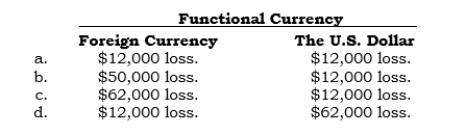

_____ On 12/31/06, Polex's payable to a foreign vendor was properly reported at $512,000 in its balance sheet after recording a $12,000 upward adjustment as a result of a change in the exchange rate. On 1/7/07, the settlement required $505,000. Also, Polex owns a foreign subsidiary. For 2006, an adverse result of $50,000 occurred in translation or remeasurement (as appropriate) for this subsidiary. What amount should be reported in the 2006 consolidated income statement under each of the following situations?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Under FAS 52, the effect of an

Q9: Under FAS 52, the effect of an

Q10: _ Under the temporal method, what is

Q11: _ Which exchange rates are used to

Q12: _ Under APB Opinion No. 23, parent

Q14: The current rate method properly reports the

Q15: Under FAS 52, "translation" is the process

Q16: When a foreign subsidiary has the U.S.

Q17: Dividend withholding taxes are a tax to

Q18: To satisfy the "invested indefinitely" condition of