Multiple Choice

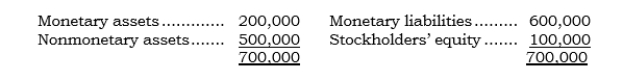

_____ Parco's German subsidiary is Sarco. On 12/31/05, Parco concluded that the euro would weaken during the remainder of 2006. On this date, Sarco's balance sheet in euros was as follows: Sarco's functional currency is the U.S. dollar. On 12/31/05, Parco entered into a 12-month FX forward to sell 100,000 euros at the forward rate of $.60 (the spot rate at the time was also $.60) . On 12/31/06, Parco settled the FX forward when the direct exchange rate was $.56. Using only the above information, what is the net amount Parco reports in its FX Gain or Loss account (that includes the remeasurement gain or loss) for 2006?

Sarco's functional currency is the U.S. dollar. On 12/31/05, Parco entered into a 12-month FX forward to sell 100,000 euros at the forward rate of $.60 (the spot rate at the time was also $.60) . On 12/31/06, Parco settled the FX forward when the direct exchange rate was $.56. Using only the above information, what is the net amount Parco reports in its FX Gain or Loss account (that includes the remeasurement gain or loss) for 2006?

A) No net gain or loss ($4,000 gain from the hedging transaction offset by a $4,000 loss from the remeasurement process) .

B) A $4,000 loss from the hedging transaction.

C) A $4,000 gain from the hedging transaction.

D) A $12,000 gain ($4,000 loss from the hedging transaction netted against a $16,000 gain from the remeasurement process) .

E) A $20,000 gain ($4,000 gain from the hedging transaction plus a $16,000 gain from the remeasurement process) .

Correct Answer:

Verified

Correct Answer:

Verified

Q95: The problem with FAS 8 was that

Q96: _ On 1/1/06, the direct exchange rate

Q97: _ Poomax has a long-term intercompany receivable

Q98: Under the PPP current-value approach, the relationships

Q99: _ On 11/11/06, Puzco sold inventory costing

Q101: _ Which of the following statements is

Q102: When the temporal method is used, any

Q103: To avoid recording income taxes on the

Q104: When the temporal method is used, the

Q105: Under the U.S. dollar unit of measure