Multiple Choice

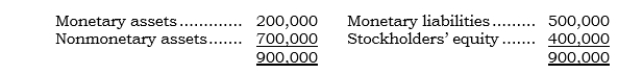

_____ Paxco has a British subsidiary, Saxco. On 12/31/05, Paxco concluded that the pound would strengthen during the remainder of 2006. On this date, Saxco's balance sheet in pounds was as follows: Saxco's functional currency is the U.S. dollar. On 12/31/05, Paxco entered into a 12-month FX forward to buy 300,000 pounds at the forward rate of $.82 (the spot rate at the time was $.80) . On 12/31/06, Paxco settled the FX forward when the spot rate was $.75. What is the net amount Paxco reports in its FX Gain or Loss account (that includes the remeasurement gain or loss) for 2006?

Saxco's functional currency is the U.S. dollar. On 12/31/05, Paxco entered into a 12-month FX forward to buy 300,000 pounds at the forward rate of $.82 (the spot rate at the time was $.80) . On 12/31/06, Paxco settled the FX forward when the spot rate was $.75. What is the net amount Paxco reports in its FX Gain or Loss account (that includes the remeasurement gain or loss) for 2006?

A) No net gain or loss.

B) $6,000 net loss.

C) $6,000 net gain.

D) $21,000 loss.

E) $37,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q104: When the temporal method is used, the

Q105: Under the U.S. dollar unit of measure

Q106: Under FAS 52, the effect of an

Q107: _ Pilax owns 100% of the outstanding

Q108: _ Under the temporal method, what is

Q110: After using the temporal method, it is

Q111: Inflationary holding gains can be either nominal

Q112: _ Povax has a long-term intercompany receivable

Q113: Under the temporal method, a decrease in

Q114: The problem with FAS 8 was that