Essay

A domestic company's 100%-owned foreign subsidiary located in Great Britain had stockholders' equity of 500,000 pounds at 1/1/06. During 2006, the subsidiary (whose functional currency is the pound) reported net income of 300,000 pounds. On 11/30/06, the subsidiary declared and paid a dividend of 100,000 pounds.

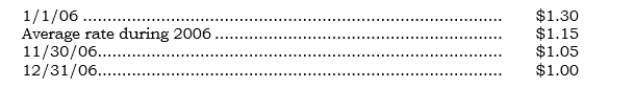

Direct exchange rate information follows:

Required:

Required:

Calculate the 2006 translation adjustment.

Correct Answer:

Verified

Correct Answer:

Verified

Q155: Mixing of valuation bases (foreign fixed assets

Q156: Under the PPP current-value approach, the focus

Q157: _ Which exchange rates are used to

Q158: Under the temporal method of translation, the

Q159: Dividend withholding taxes, when recorded, are recorded

Q161: Under current U.S. GAAP, the temporal method

Q162: A factor to be considered in determining

Q163: When the temporal method is used, any

Q164: _ Panex owns 100% of the outstanding

Q165: Under FAS 52, it may be necessary