Essay

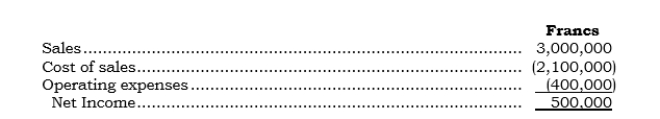

A domestic company's 100%-owned foreign subsidiary located in Switzerland submitted the following income statement for 2006:

Additional information:

Additional information:

a. Inventory decreased 100,000 francs during 2006.

b. Sales, purchases, and operating expenses occurred or were incurred evenly throughout the year. (Operating expenses include depreciation expense of 100,000 francs.)

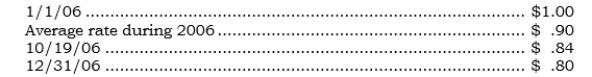

c. The subsidiary, whose functional currency is the U.S. dollar, had at the beginning of 2006 monetary assets of 1,000,000 francs, monetary liabilities of 700,000 Swiss francs, and stockholders' equity of 1,500,000 Swiss francs.

d. On 10/19/06, the subsidiary declared and paid a cash dividend of 200,000 Swiss francs.

e. Cash disbursements for 2006 were 2,500,000 francs.

f. Direct exchange rate information follows:

Required:

Required:

Calculate the 2006 foreign currency transaction gain or loss arising from the change in the exchange rate.

Correct Answer:

Verified

Correct Answer:

Verified

Q71: _ Which of the following statements is

Q72: The PPP current-value approach results in mixing

Q73: A gain in name only is called

Q74: _ Unrealized inflationary holding gains resulting from

Q75: _ Paltex's foreign subsidiary reported depreciation expense

Q77: _ The U.S. dollar is the functional

Q78: _ Parrex has a foreign subsidiary, Sarrex.

Q79: Under APB Opinion No. 23, parent-level income

Q80: _ Pindax owns 100% of the outstanding

Q81: _ Which of the following statements is