Essay

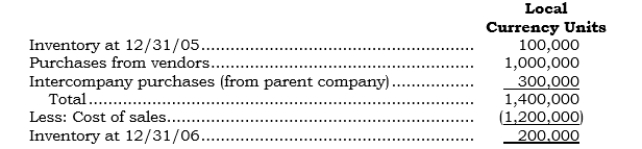

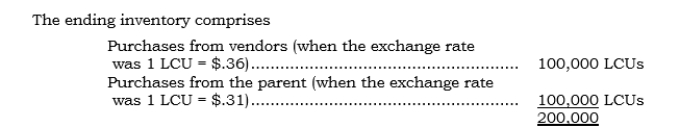

A foreign subsidiary has provided the following information with respect to its year-end inventories and cost of sales for 2006:

Additional information:

Additional information:

a. The subsidiary's sales occurred evenly throughout the year.

b. The average exchange rate during the year was 1 LCU = $.40.

c. Purchases from vendors occurred during the first nine months, when the average rate was 1 LCU = $.42.

d. The intercompany purchases from the parent all occurred in the last three months, when the average exchange rate was 1 LCU = $.33. (The parent recorded these intercompany sales in its general ledger at $96,000.)

e. The current rate at 12/31/06 was 1 LCU = $.30.

f. The beginning inventory was reported at $50,000 in the 12/31/05 balance sheet (as expressed in U.S. dollars).

g. Assume that no lower-of-cost-or-market test in U.S. dollars need be performed at 12/31/06.

h.  Required:

Required:

a. Assuming that the foreign currency is the functional currency, determine the amounts at which the cost of sales for 2006 and inventory at 12/31/06 would be reported in U.S. dollars.

b. Same as Requirement a, but assume that the U.S. dollar is the functional currency.

Correct Answer:

Verified

Correct Answer:

Verified

Q60: Under FAS 52, a foreign unit in

Q61: A decrease in the direct exchange rate

Q62: The functional currency concept is based on

Q63: The risk of investing in foreign countries

Q64: Under FAS 52, the effect of an

Q66: _ During 2006, a foreign subsidiary had

Q67: Under FAS 52, the effect of an

Q68: _ Under FAS 52, how is the

Q69: Under FAS 52, the U.S. dollar is

Q70: _ Which of the following items is