Short Answer

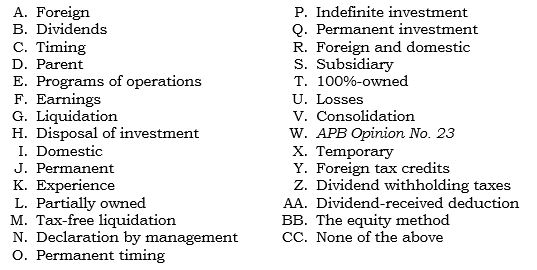

Using the following answer code, select the proper letter(s) and insert it (them) in the space provided:

a. _____ _____ The two things in APB Opinion No. 23 that allow the nonprovision for taxes on the net income of subsidiaries.

a. _____ _____ The two things in APB Opinion No. 23 that allow the nonprovision for taxes on the net income of subsidiaries.

b. _____ _____ The category of subsidiary to which the 100% dividend received deduction is applicable.

c. _____ _____ The two examples of evidence required to satisfy the conditions for indefinite investment.

d. _____ _____ On whose books are dividend withholding taxes recorded?

e. _____ _____ The type of subsidiary with which a domestic parent can file a consolidated income tax return. (This does not pertain to ownership percentage; the answer is not T.)

f. _____ _____ Something that is applicable only to foreign subsidiaries.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: The current rate method properly reports the

Q15: Under FAS 52, "translation" is the process

Q16: When a foreign subsidiary has the U.S.

Q17: Dividend withholding taxes are a tax to

Q18: To satisfy the "invested indefinitely" condition of

Q20: FAS 8 used a(n) _ unit of

Q21: Under FAS 52, only the current rate

Q22: A U.S. parent's French subsidiary has the

Q23: _ Under the temporal method of translation,

Q24: _ For the reporting of earnings of