Short Answer

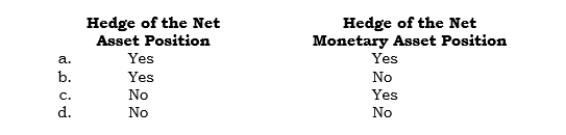

_____ A parent owns a foreign subsidiary that has as its functional currency the local currency. During 2006, the foreign subsidiary had (a) a net asset position of 500,000 LCUs and (b) a net monetary asset position of 400,000 LCUs. Which of the following gains or losses on hedging transactions can be charged or credited to the parent's OCI-Translation Adjustment account?

Correct Answer:

Verified

Correct Answer:

Verified

Q59: _ Penex has an intercompany receivable denominated

Q60: When the current rate method is used,

Q61: Under the foreign currency unit of measure

Q62: The three translation approaches that can be

Q63: When the current rate method is used,

Q65: When the current rate method is used,

Q66: _ Under FAS 52, which translation procedures

Q67: _ During 2006, the Mexican peso weakened.

Q68: Under the foreign currency unit of measure

Q69: _ Which exchange rates are used to