Short Answer

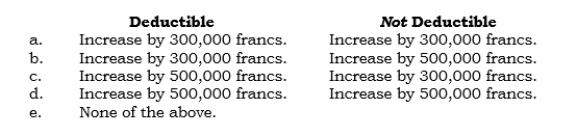

_____ A Swiss subsidiary follows the practice of recording a liability for potential future losses at its manufacturing location (which is not insured). The offsetting debit to income is in accordance with Swiss GAAP and is deductible under Swiss tax laws. The liability account had a balance of 500,000 francs at the beginning of 2006. During 2006, 100,000 francs were added to the account, and 40,000 francs were charged against the liability account as a result of fire damage from an accident. The Swiss income tax rate is 40%. What adjustment is required to the subsidiary's beginning Retained Earnings, assuming that under Swiss income tax law, additions to the liability account are either deductible or not deductible?

Correct Answer:

Verified

Correct Answer:

Verified

Q32: _ On 12/31/06, a Danish subsidiary accrued

Q33: Under the foreign currency unit of measure

Q34: _ Which of the following is not

Q35: _ On 4/1/07, Pakco sold its foreign

Q36: Under the foreign currency unit of measure

Q38: When the current rate method is used,

Q39: _ Under FAS 52, how is the

Q40: _ Which of the following accounts is

Q41: Under FAS 52, the AOCI-Cumulative Translation Adjustment

Q42: _ Which exchange rates are used to