Multiple Choice

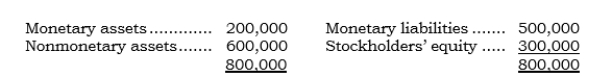

_____ Paxco has an English subsidiary, Saxco. On 1/1/06, Paxco concluded that the pound would strengthen during the remainder of 2006. On this date, Saxco's balance sheet in pounds was as follows: Saxco's functional currency is the pound. On 1/1/06, Paxco entered into a 12-month FX forward to buy 300,000 pounds at the forward rate of $.82 (the spot rate at the time was $.80) . On 12/31/06, Paxco settled the FX forward when the direct spot exchange rate was $.75. What is the change in Paxco's AOCI-Cumulative Translation Adjustment account for 2006?

Saxco's functional currency is the pound. On 1/1/06, Paxco entered into a 12-month FX forward to buy 300,000 pounds at the forward rate of $.82 (the spot rate at the time was $.80) . On 12/31/06, Paxco settled the FX forward when the direct spot exchange rate was $.75. What is the change in Paxco's AOCI-Cumulative Translation Adjustment account for 2006?

A) $15,000 decrease from the translation process.

B) $21,000 decrease from the hedging transaction.

C) $30,000 decrease ($15,000 from the translation process and $15,000 from the hedging transaction) .

D) $36,000 decrease ($15,000 from the translation process and $21,000 from the hedging transaction) .

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q45: _ When using a foreign currency unit

Q46: When the current rate method is used,

Q47: _ Pazco sold inventory costing $50,000 to

Q48: When the current rate method is used

Q49: _ Which of the following accounts is

Q51: _ Following are certain items (accounts or

Q52: When the current rate method is used,

Q53: _ Under FAS 52, how is the

Q54: Under the foreign currency unit of measure

Q55: Under the foreign currency unit of measure