Short Answer

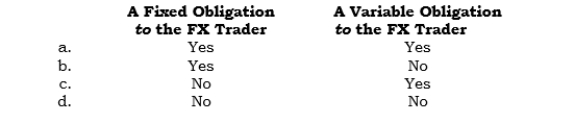

_____ In an FX forward entered into for hedging an exposed receivable, the exporter (from a dollar perspective) has

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q211: In a derivative, the major concern is

Q212: The issue of split accounting emcompasses<br>A)

Q213: Split accounting is not a possibility for

Q214: Hedging a domestic company's budgeted export sales

Q215: Any portion of a derivative's FX gain

Q217: Hedging a firm commitment is a cash

Q218: Split accounting encompasses both (1) the manner

Q219: Hedging a foreign currency payable is protecting

Q220: In a derivative, the party that is

Q221: A specific foreign currency exposure being hedged