Multiple Choice

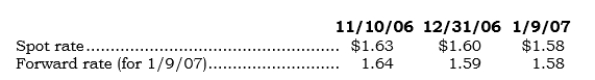

_____ On 11/10/06, Buymax entered into a 60-day FX forward involving 100,000 British pounds to hedge a firm purchase commitment. Buymax took delivery on 1/9/07. Direct exchange rates on the respective dates are as follows: What is the FX gain or loss to be reported in earnings for 2006 on the FX forward?

What is the FX gain or loss to be reported in earnings for 2006 on the FX forward?

A) $ -0-

B) $3,000 gain.

C) $3,000 loss.

D) $5,000 gain.

E) $5,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Split accounting treatment achieves hedge accounting treatment.

Q2: In a fair value hedge, the concern

Q4: _ Which of the following is not

Q5: Companies manage their foreign currency exposures by

Q6: When a domestic exporter desires to hedge

Q7: _ Split accounting in the context of

Q8: Hedge accounting is defined as accounting for

Q9: _ Which of the following is not

Q10: In a derivative, credit risk and market

Q11: Hedging a domestic company's budgeted import purchases