Multiple Choice

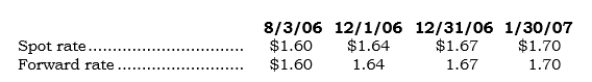

_____ On 8/3/06, Buyox entered into a noncancellable purchase agreement with a British vendor involving a custom-made machine. Buyox took delivery of the machine on 12/1/06 (120 days later) . The purchase price was 100,000 pounds, which Buyox remitted to the vendor on l/30/07 (60 days after delivery) . Direct exchange rates on the respective dates are as follows: Also on 8/3/06, Buyox entered into a 180-day FX forward to buy 100,000 pounds. What is the FX gain or loss recognized in earnings for 2006 on the FX commitment?

Also on 8/3/06, Buyox entered into a 180-day FX forward to buy 100,000 pounds. What is the FX gain or loss recognized in earnings for 2006 on the FX commitment?

A) $ -0-

B) $4,000 gain.

C) $4,000 loss.

D) $7,000 gain.

E) $7,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q66: In an FX forward that hedges a

Q67: Hedging the potential loss of domestic sales

Q68: _ Hedging a forecasted transaction is a<br>A)

Q69: To "write" an option, an entity must

Q70: _ Hedge accounting is a special accounting

Q72: _ In a derivative, "on-balance-sheet risk" is

Q73: Hedging a forecasted transaction is a fair

Q74: Options that are "in the money" have

Q75: _ Hedging an existing FX receivable arising

Q76: Gains and loses on derivatives cannot be