Multiple Choice

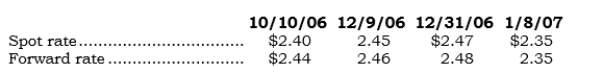

_____ On 10/10/06, Selcor entered into a noncancellable sales agreement with a foreign customer to sell a custom-made machine. Selcor delivered the machine on 12/9/06 (60 days later) . The sales price was 100,000 LCUs, which Selcor received on 1/8/07 (30 days after delivery) . Direct exchange rates on the respective dates are as follows: Also on 10/10/06, Selcor entered into a 90-day FX forward to sell 100,000 LCUs. What should be the recorded sales price of the equipment?

Also on 10/10/06, Selcor entered into a 90-day FX forward to sell 100,000 LCUs. What should be the recorded sales price of the equipment?

A) $240,000

B) $242,000

C) $243,000

D) $244,000

E) $245,000

Correct Answer:

Verified

Correct Answer:

Verified

Q114: An option to buy is a(n) _.

Q115: FX gains and losses on fair value

Q116: _ FX gains and losses on cash

Q117: _ In an FX forward entered into

Q118: _ On 11/10/06, Selmax entered into a

Q120: _ On 1/1/06, Callex purchased a 1-year

Q121: _ In an option-based derivative, the option

Q122: FX forwards can be tailored to the

Q123: _ Which of the following statements is

Q124: FX gains and losses on cash flow