Essay

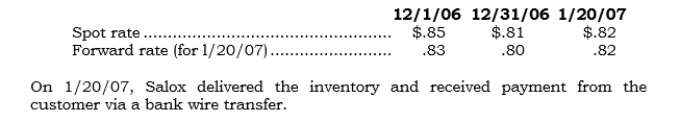

On 12/1/06, Salox entered into a 50-day FX forward to hedge a noncancellable sales order it received that day that will require payment of 1,000,000 euros in 50 days by a French customer. Direct exchange rates for the euro are as follows:

Required:

Required:

a. Prepare all journal entries relating to the FX forward over the contract's life.

b. Prepare the journal entry to record the inventory sale.

Correct Answer:

Verified

Correct Answer:

Verified

Q141: _ In assessing hedge effectiveness, which of

Q142: Hedge accounting is not defined as accounting

Q143: _ FX forwards are valued using<br>A) The

Q144: _ Concerning FX forwards, which of the

Q145: Accounting for premiums and discounts separately from

Q147: The party having the obligation to honor

Q148: Hedging a domestic company's budgeted export sales

Q149: _ A domestic importer has an FX

Q150: In a fair value hedge, the concern

Q151: In a fair value hedge, the concern