Essay

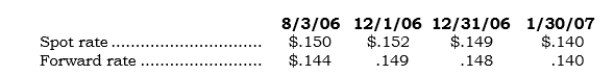

On 8/3/06, Salorc obtained a noncancelable sales order from a Norwegian customer for a chip-making machine. The contract price was 1,000,000 Nor-wegian krona. Concurrently, Salorc entered into a 180-day FX forward to sell 1,000,000 Norwegian krona at the forward rate of $.144. Salorc delivered the machinery on 12/1/06 and received payment on 1/30/07 via a bank wire transfer. Direct exchange rates for Norwegian krona are as follows:

Required:

Required:

a. Prepare a partial balance sheet for Salorc at 12/31/06.

b. Prepare a partial income statement for Salorc for 2006.

Correct Answer:

Verified

Correct Answer:

Verified

Q163: _ On 1/1/06, Putax purchased a 1-year

Q164: _ Concerning FX forwards, which of the

Q165: FX forwards are _ in nature.

Q166: _ A company that enters into an

Q167: In assessing hedge effectiveness, the change in

Q169: For an FX forward to qualify as

Q170: _ Which of the following is not

Q171: In FX forwards, only one party to

Q172: In an FX forward, hedge accounting is

Q173: _ A domestic exporter has an FX