Essay

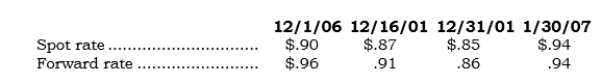

On 12/1/06, Purorc ordered machinery (under a noncancelable purchase order) from a Dutch vendor. The contract price was 1,000,000 euros. Concurrently, Purorc entered into a 60-day FX forward to buy 1,000,000 euros at the forward rate of $.96. Purorc took delivery of the machinery on 12/16/06 and paid the vendor on 1/30/07 via a bank wire transfer. Direct exchange rates for euros are as follows:

Required:

Required:

a. Prepare a partial balance sheet for Purorc at 12/31/06. (Be sure to include the machine as a fixed asset.)

b. Prepare a partial income statement for Purorc for 2006.

Correct Answer:

Verified

Correct Answer:

Verified

Q103: _ Concerning FX forwards, which of the

Q104: Derivative financial instruments are contracts that create

Q105: _ Which of the following is not

Q106: Hedging a forecasted transaction is generally a

Q107: In a cash flow hedge, the concern

Q109: An option to buy is referred to

Q110: _ A domestic company wishes to hedge

Q111: Hedging a firm commitment is generally a

Q112: Companies can hedge strategic or competitive exposures.

Q113: _ In a derivative, "off-balance-sheet risk" is