Essay

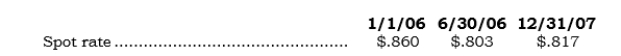

On 1/1/06, Forcax purchased an at-the-money foreign currency put option from an FX trader involving 1,000,000 euros at a cost of $14,000. The option expires on 12/31/06 and is exercisable at $.85. The option was (a) obtained to hedge Forcax's budgeted 2006 export sales to Germany and (b) exercised on 12/31/06. For simplicity, assume that the only interim reporting date was 6/30/06, when the option's fair value was $54,000. Actual export sales to Germany for the first six months of 2006 were 400,000 euros. Direct exchange rates for the euro are as follows:

Required:

Required:

Prepare all journal entries relating to the FX option.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: _ FX gains and losses on cash

Q39: _ A company that enters into an

Q40: _ Which of the following is not

Q41: _ A domestic company wishes to hedge

Q42: _ Which of the following statements is

Q44: Derivative financial instruments are contracts that create

Q45: _ On 8/3/06, Buyox entered into a

Q46: Split accounting deals solely with the manner

Q47: In a derivative, a party cannot have

Q48: In a fair value hedge, the concern