Short Answer

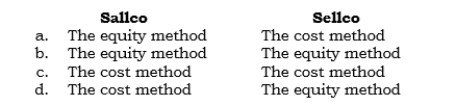

_____ Pallco justifiably does not consolidate two of its 100%-owned subsidiaries (Sallco and Sellco). Sallco is (a) a foreign subsidiary and (b) prohibited by the foreign government from paying dividends. Sellco is (a) a domestic subsidiary acquired two months ago in the purchase of a conglomerate and (b) in process of being sold. What would be the most likely method of accounting for each of these unconsolidated subsidiaries?

Correct Answer:

Verified

Correct Answer:

Verified

Q105: Under the parent company concept, the NCI

Q106: _ Which of the following methods does

Q107: Under current GAAP, _ consolidation is required.

Q108: _ Prell's 100%-owned domestic subsidiary has filed

Q109: In consolidating a VIE, goodwill can never

Q111: The double corporate taxation possibility does not

Q112: When a consolidated income tax return is

Q113: The U.S. income tax system taxes worldwide

Q114: _ Sixx is a 60%-owned domestic subsidiary

Q115: A domestic company cannot file a consolidated