Multiple Choice

matching

based on the information given.

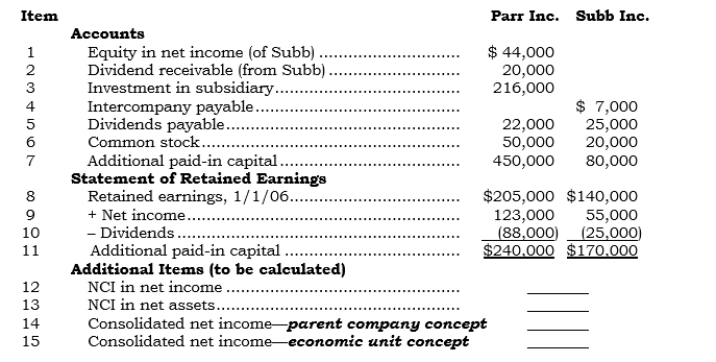

The following (a) seven account balances and (b) statements of retained earnings were obtained from the separate company statements of Parr Inc. and its 80%-owned created sub-sidiary, Subb Inc. (Parr's only subsidiary) , at the end of 2006:

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 1:

How is each of the first 11 preceding items reported in Parr's 2006 consolidated statements? Use the following list of possible answer codes in the answer columns:

-_____(item 1)

A) Report at the amount shown in Subb's separate statements.

B) Report at the amount shown in Parr's separate statements.

C) Report at less than the sum of the amounts shown in Parr's and Subb's separate statements.

D) Report at the sum of the amounts shown in Parr's and Subb's separate statements.

E) Do not report this item in the consolidated statements or in the separate statements of either Parr or Subb.

F) Do not report this item in the consolidated statements.

G) Create this item in the consolidation process.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: An advantage of filing a consolidated income

Q43: A parent may file a consolidated income

Q44: _ Under the FASB's 1999 exposure draft

Q45: A concept of viewing the noncontrolling interest

Q46: In consolidating a VIE, the VIEs assets

Q48: _Entity A will absorb a majority of

Q49: When a subsidiary distributes its earnings to

Q50: The fair value method of valuing an

Q51: Another term for the noncontrolling interest is

Q52: A foreign subsidiary will not pay taxes