Short Answer

based on the information given.

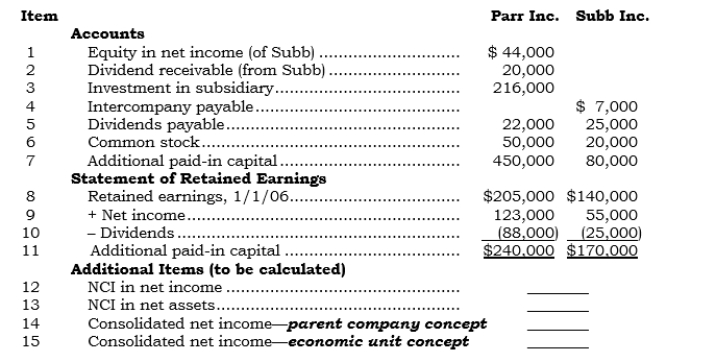

The following (a) seven account balances and (b) statements of retained earnings were obtained from the separate company statements of Parr Inc. and its 80%-owned created sub-sidiary, Subb Inc. (Parr's only subsidiary), at the end of 2006:

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 2:

For items 12-15, calculate the amount that would appear in the 2006 consolidated statements

-_____(item 15)

Correct Answer:

Verified

Correct Answer:

Verified

Q128: The 100% dividend received deduction is applicable

Q129: _ The NCI in a created subsidiary's

Q130: Dividends paid to noncontrolling shareholders are treated

Q131: To file a consolidated income tax return,

Q132: When a company has a subsidiary instead

Q133: _ To file a consolidated tax return,

Q134: Under the economic unit concept, the NCI

Q136: Section 482 problems are avoided if a

Q137: A foreign subsidiary is not consolidated because

Q138: The "dividend received deduction" applies only to