Multiple Choice

Figure 5.4

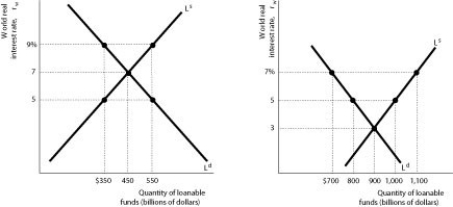

Suppose the world consists of two large open economies, Canada and the rest of the world. The figures above represent loanable funds graphs for these two economies.

-Refer to Figure 5.4.At an interest rate of 7%,

A) foreign borrowers want to borrow more from international capital markets than is available.

B) Canadian borrowers want to borrow more from the domestic market than is available.

C) foreign lenders have more to lend in international capital markets than meets demand.

D) Canadian borrowers want to borrow less in international capital markets than is available.

Correct Answer:

Verified

Correct Answer:

Verified

Q71: If the world real interest rate were

Q72: The return that a domestic investor receives

Q73: What is the difference between nominal exchange

Q74: If the current account is in surplus

Q76: When the Bank of Canada pursues a

Q77: Figure 5.2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 5.2

Q78: Other things equal,if foreign holdings of Canadian

Q79: <span class="ql-formula" data-value="\quad "><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mspace

Q81: Which of the following best represents government

Q274: Why is the balance of payments always