Multiple Choice

Figure 5.4

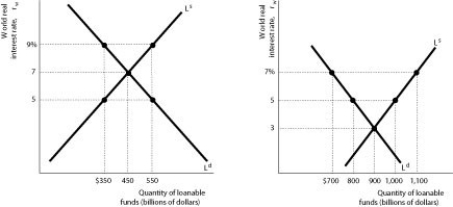

Suppose the world consists of two large open economies, Canada and the rest of the world. The figures above represent loanable funds graphs for these two economies.

-Refer to Figure 5.4.The international capital market will be in equilibrium when the real interest rate in Canada is ________ and the real interest rate in the rest of the world is ________.

A) 7%; 3%

B) 5%; 7%

C) 9%; 3%

D) 5%; 5%

Correct Answer:

Verified

Correct Answer:

Verified

Q9: One disadvantage of a fixed exchange rate

Q10: Which of the following is an example

Q11: Purchasing power parity does a _ job

Q12: One advantage of a floating exchange rate

Q13: <span class="ql-formula" data-value="\quad "><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mspace

Q15: Figure 5.3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 5.3

Q16: Which of the following best represents total

Q17: All else equal,an increase in the government's

Q18: Figure 5.1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 5.1

Q19: Figure 5.1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 5.1