Multiple Choice

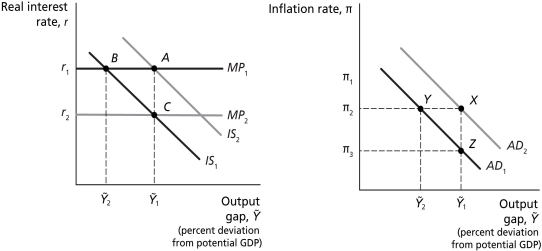

Figure 14.1

-Refer to Figure 14.1.Other things equal,a decrease in taxes is best represented as a movement from

A) point Y to point Z.

B) point Z to point X.

C) point Z to point Y.

D) point Y to point X.

Correct Answer:

Verified

Correct Answer:

Verified

Q55: Figure 14.1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 14.1

Q56: Suppose the Bank of Canada has a

Q57: Figure 14.1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 14.1

Q58: Suppose the central bank announces that it

Q59: If the central bank is facing the

Q61: If the economy experiences an unanticipated demand

Q62: Explain why some shifts to the aggregate

Q63: Other things equal,if the central bank raises

Q64: Figure 14.3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 14.3

Q65: Figure 14.2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 14.2