Multiple Choice

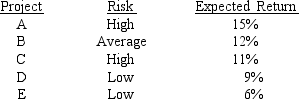

Laramie Labs uses a risk-adjustment when evaluating projects of different risk.Its overall (composite) WACC is 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Laramie evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

A) A and B.

B) A, B, and C.

C) A, B, and D.

D) A, B, C, and D.

E) A, B, C, D, and E.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: McLeod Inc.is considering an investment that has

Q9: Tallant Technologies is considering two potential projects,X

Q13: You have just landed an internship

Q14: Which of the following statements is CORRECT?<br>A)

Q30: We can identify the cash costs and

Q32: Although it is extremely difficult to make

Q64: Which of the following should be considered

Q66: Which of the following statements is CORRECT?<br>A)

Q67: A firm that bases its capital budgeting

Q76: Which of the following statements is CORRECT?<br>A)