Multiple Choice

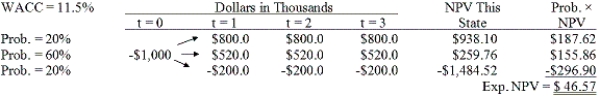

Brandt Enterprises is considering a new project that has a cost of $1,000,000,and the CFO set up the following simple decision tree to show its three most likely scenarios.The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so,but to obtain this abandonment option,it would have to make a payment to those parties.How much is the option to abandon worth to the firm?

A) $55.08

B) $57.98

C) $61.03

D) $64.08

E) $67.29

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following statements is CORRECT?<br>A)

Q3: The primary advantage to using accelerated rather

Q8: It is extremely difficult to estimate the

Q18: The two cardinal rules that financial analysts

Q22: Which of the following statements is CORRECT?<br>A)

Q29: Opportunity costs include those cash inflows that

Q43: Erickson Inc.is considering a capital budgeting project

Q56: Garden-Grow Products is considering a new

Q71: In cash flow estimation, the existence of

Q72: Collins Inc.is investigating whether to develop a