Multiple Choice

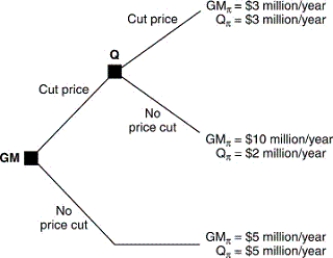

Consider the following decision tree.This tree illustrates hypothetical payoffs to General Mills (GM) and Quaker Oats (Q) if they engage in a price war.

If GM cuts prices,the greatest potential gain is:

A) $5 million per year.

B) $10 million per year.

C) $2 million per year.

D) $3 million per year.

E) none of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Given the following payoff matrix,who has a

Q12: Refer to the accompanying payoff matrix.Which of

Q13: Which pair of strategies would cooperative cartel

Q14: A feasible strategy set is:<br>A) all actions

Q15: How many Nash equilibria are there in

Q17: Suppose that firm A finds itself facing

Q18: If player 1 has a dominant strategy,then

Q19: If a firm has a dominant strategy:<br>A)

Q20: Potential entrant E threatens to enter incumbent

Q21: A most-favored-customer clause:<br>A) is a commitment but