Essay

Pierre & Sons is a baked-goods manufacturing firm. Pierre has two main divisions: Packaged Mixes and Finished Desserts. The Finished Desserts division is considering purchasing the mix for its cakes from an outside supplier.

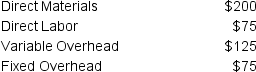

The Packaged Mixes department incurs the following costs for each batch of cake mix:

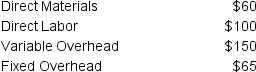

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes:

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes:

Currently, the Packaged Mixes department has excess capacity. Peterson currently sells the mix for $500 per batch. The Finished Desserts department is able to purchase the mix for $350 from an outside supplier. The finished cakes from each batch will sell for a total of $1,000.

Currently, the Packaged Mixes department has excess capacity. Peterson currently sells the mix for $500 per batch. The Finished Desserts department is able to purchase the mix for $350 from an outside supplier. The finished cakes from each batch will sell for a total of $1,000.

Based on the decision that will maximize the overall benefit to Peterson & Sons, what is the contribution margin per batch that can be realized by the Finished Desserts department?

Correct Answer:

Verified

Because the Packaged Mixes department is...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: How does the DuPont formula provide further

Q18: The following information is available for Happy

Q19: Unplanned increases in per-unit costs could be

Q20: HSS Company provides security services to

Q21: The transfer price should be sufficient to

Q23: Use the following information to complete Problems

Q24: Profit center managers must be concerned about

Q25: Christensen & Co. is a manufacturing company

Q26: Which of the following would not be

Q27: Use the following information to complete Problems