Essay

Pierre & Sons is a baked-goods manufacturing firm. Pierre has two main divisions: Packaged Mixes and Finished Desserts. The Finished Desserts division is considering purchasing the mix for its cakes from an outside supplier.

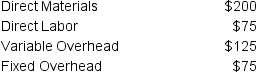

The Packaged Mixes department incurs the following costs for each batch of cake mix:

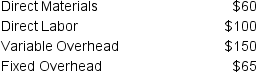

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes:

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes:

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide cake mix to the Finished Desserts department. Management estimates that $125 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Desserts department is $500: this is the price at which Peterson can purchase the mix from an outside supplier. The finished cakes from each batch will sell for $1,000.

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide cake mix to the Finished Desserts department. Management estimates that $125 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Desserts department is $500: this is the price at which Peterson can purchase the mix from an outside supplier. The finished cakes from each batch will sell for $1,000.

Based on the decision that will maximize the overall benefit to Pierre & Sons, what is the contribution margin per batch that can be realized by the Finished Desserts department?

Correct Answer:

Verified

Variable Costs for the Packaged Mixes de...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: Use the following information to answer Problems

Q72: Which of the following are not reasons

Q73: MC Ryan Inc. is a manufacturing company

Q74: Which of the following is needed in

Q75: An investment center manager is mostly concerned

Q77: Conceptually, what is the minimum transfer price?

Q78: Christensen & Co. is a manufacturing company

Q79: The budgeted level of activity often differs

Q80: Tapping Danes Inc. is a manufacturing company

Q81: Conner Manufacturing has two major divisions. Management