Multiple Choice

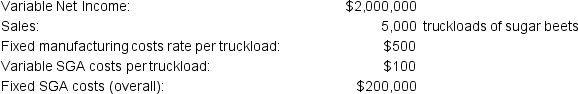

H3 Co. is a farming corporation that grows and sells sugar beets. The company is publicly traded on the stock market: however, management prefers to use variable costing for decision purposes. The company's books are adjusted to arrive at Absorption Income for financial reporting purposes. The company reported the following financial information for the past month: The company tracks harvested crops that have not yet been shipped out as "in-process." This inventory of sugar beets increased from the equivalent of 50 full truckloads at the beginning of the month to 70 full truckloads at the end of the month.

The company tracks harvested crops that have not yet been shipped out as "in-process." This inventory of sugar beets increased from the equivalent of 50 full truckloads at the beginning of the month to 70 full truckloads at the end of the month.

What was Absorption Net Income?

A) $1,988,000

B) $2,012,000

C) $1,990,000

D) $2,020,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q17: PackALot Manufacturing produces a single product, small

Q18: Dumpling Makers Co., (DMC), uses variable costing

Q19: When production is greater than sales, is

Q20: Under absorption costing, managers may have an

Q21: How can variable costing mitigate the pressure

Q23: Under absorption costing, a change in the

Q24: Sunlight Manufacturing produces a single product, fluorescent

Q25: Which costing type calculates Contribution Margin?

Q26: Home Resorts, a residential pool installation company,

Q27: PackALot Manufacturing produces a single product, small