Essay

CES Inc. is considering obtaining a bank loan to finance a new operation. The company is required by the bank to submit GAAP-compliant accounting records (which they currently do not keep). CES has contracted with your consulting firm to estimate the costs and benefits of this new operation.

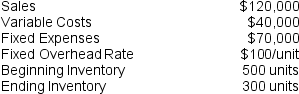

Management provides you with the following information regarding their financial position:

Expected performance next month (before considering the potential investment):

The loan contract has the following information:

The loan contract has the following information:

Bank loan: $500,000

Interest rate: 1% per month, payable at the end of the month. Interest rate increases to 1.5% per month if the company suffers a net Operating Loss before Interest and Taxes that month (by GAAP standards).

After evaluating the company, you report the following estimates:

Monthly cost of keeping a second set of accounting records: $5,000

Potential return on investment: 2% per month (through increased sales, after considering the costs involved).

Would you recommend that CES take out the loan (i.e. would it be profitable for them)?

Correct Answer:

Verified

Variable operating income for next month...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: How does Net Income respond to changes

Q67: Under variable costing, contribution margin is equal

Q68: Split Yellow Co. is a banana plantation

Q69: Which of the following will not affect

Q70: Sunlight Manufacturing produces a single product, fluorescent

Q72: One of the advantages of variable costing

Q73: CookieClub Co. uses variable costing for managerial

Q74: Which of the following is not a

Q75: Organic Food Market (OFM) is a local

Q76: Working capital tends to be lower under