Essay

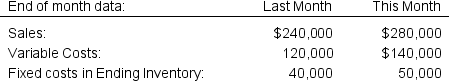

Shoots & Leaves, (SL), is a local health food store that uses an absorption costing approach when pricing their goods, in order to make sure that their fixed costs are covered. All costs except purchasing-related variable costs (such as the supplier price of the goods and the shipping costs) are considered fixed costs and are allocated to inventory. The allocation is made when each item is purchased, and is based on the sales mark-up of each item, at a rate of $0.70/dollar. Any under- or over-applied overhead is closed to Cost of Goods Sold. Financial information for this month and last month are as follows.

Over-applied overhead for this month was $5,000. The owners of SL want to increase income, and want to know if the best way to do that is to increase sales volume or to barter with suppliers for lower prices. To assist in making the decision, they want to know what Operating Income would be under Variable costing rather than Absorption costing, in order to remove the effect of inventoried fixed costs.

Over-applied overhead for this month was $5,000. The owners of SL want to increase income, and want to know if the best way to do that is to increase sales volume or to barter with suppliers for lower prices. To assist in making the decision, they want to know what Operating Income would be under Variable costing rather than Absorption costing, in order to remove the effect of inventoried fixed costs.

What would Variable Operating Income be this month?

Correct Answer:

Verified

Variable Operating Income = Absorption O...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: How does absorption costing create the opportunity

Q46: TBody Inc. produces exercise workout videos for

Q47: Sunflower, Inc. is considering obtaining a

Q48: How are variable selling and administrative costs

Q49: Workout, Inc. produces exercise workout videos for

Q51: Which of the following is not a

Q52: Wet Pets Inc. makes 100-gallon plexiglass aquariums.

Q53: Variable costing is required by GAAP for

Q54: How might working capital be understated under

Q55: The difference between variable net income and