Essay

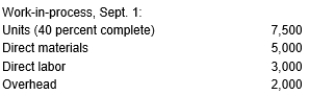

Casey Company manufactures a product that passes through two processes: Mixing and Packaging. The costs incurred for the Mixing Department for September follow:

During Sept., 75,000 units were completed and transferred to Packaging. The following costs were incurred by the Mixing Department during September:

During Sept., 75,000 units were completed and transferred to Packaging. The following costs were incurred by the Mixing Department during September:

There were 9,000 units that were 70 percent complete remaining in the Mixing Department at Sept. 30. Use the weighted average method and round unit costs to 2 decimal places.

There were 9,000 units that were 70 percent complete remaining in the Mixing Department at Sept. 30. Use the weighted average method and round unit costs to 2 decimal places.

Required:

a. Determine the equivalent units in process for September.

b. Determine the Total Costs To Account For in September.

c. Determine the costs per equivalent unit assuming all costs are added uniformly during the mixing process.

d. Determine the Accounting for Total Costs.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The ability to present an income statement

Q2: For each of the following independent manufacturing

Q3: What is the purpose for using predetermined

Q4: Which of the following costs are treated

Q6: Texas Company manufactures a product through a

Q7: Justin Company had the following data for

Q8: The cost per equivalent unit for materials

Q9: Fixed non-manufacturing costs are classified as period

Q10: Northern Company manufactures a product that passes

Q11: All depreciation on factory assets is recorded