Essay

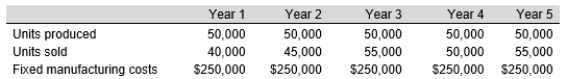

The Grand Rapid Corporation has two identical divisions: Western and Northern. Their sales, production volume, and fixed manufacturing costs have been the same for both divisions for the last five years and are as follows:

Western uses absorption costing and Northern uses variable costing. Both use FIFO inventory methods. Variable manufacturing costs are $5 per unit. Both have identical selling prices and selling and administrative expenses. There were no Year 1 beginning inventories.

Western uses absorption costing and Northern uses variable costing. Both use FIFO inventory methods. Variable manufacturing costs are $5 per unit. Both have identical selling prices and selling and administrative expenses. There were no Year 1 beginning inventories.

Determine the difference in profits for each division for Years 1 through 5. Explain why profits differ between the two divisions.

Correct Answer:

Verified

Fixed manufacturing per unit is $250,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Sykora, Inc., which uses a predetermined overhead

Q57: Which of the following is not included

Q58: Lorraine Corp. obtained the following information from

Q59: Classify the following costs incurred in the

Q60: Inventory values calculated using variable costing as

Q62: The beginning inventory consisted of 10,000 units,

Q63: Marni Corp. obtained the following information from

Q64: Stanley Steel Company reported the following units

Q65: When is the cost of manufacturing equipment

Q66: The following information pertains to Jack Corporation:<br><img